Amy Alba & Evan Shapiro's Prediction for Streaming Hybrid Revenue Models with the Boom of Product Placements

I recently sat down with Evan Shapiro for an industry coffee chat about the Ad Sales TV Industry...

[Overview and Impact of Nielsen Accreditation]

Nielsen has been the gold standard in audience measurement for the past seventy years. Changes in consumer viewing habits has resulted in an explosive growth of paid/ad-free streaming platforms, as well as a 39% increase in streaming audio consumption. Nielsen’s research had done little to address this shift and destabilization in the marketplace. As viewing habits have become more fractured, and viewers become less bound to TV schedules, the current ratings system’s focus on live and recently recorded TV has become a problem for audience measurement and accurate data. During the pandemic, Nielsen didn’t dispatch field agents to monitor the technology it has with individuals contracted to report viewing to Nielsen and did not replace panelists as they relocated around the nation. Additionally, Nielsen also benefited from a reduction in the workforce necessary to manage its sample households, which likely contributed to a reduction in the representation of households in its sample. Inaccurate, underreporting of ratings data on the part of Nielsen had been speculated for years and was only exacerbated, during the pandemic, leading to significant viewership undercounting. Confirmation by the VAB and cable TV networks who claimed Nielsen had undercounted audiences resulting in a loss of 20% respondent households. The VAB says during the pandemic the people meter in-tab (the households providing usable ratings for the day), had dropped from 36,957 households in February 2020 to 29,456 in February 2021. This undercounting has negatively impacted TV ratings during the pandemic. Nielsen says the VAB’s numbers are incorrect.

The flaws and caveats in the Nielsen systems are not something new to the industry; resulting in the MRC launching a review and confirming with the loss of accreditation there is no confidence in the data from Nielsen within the industry. The MRC, whose membership includes many VAB members, found in February that Nielsen had likely undercounted adults 18-to-49 viewers by 2% to 6%. In addition, TV usage for adults 18-to-48 was down by 1% to 5%. during the pandemic. An analysis released by the Video Advertising Bureau estimates the cost of the national TV ratings understatement in terms of lost advertising revenues to the TV industry was as much as $2.8 billion.

GroupM in June sent its marketer clients a memo cautioning them against relying on Nielsen’s Digital Ad Ratings tool, which measures digital ad views and the demographics the ad reached, for ad campaigns across computer, mobile and internet-connected devices. GroupM, cited concerns such as the product’s accreditation hiatus from the MRC, Nielsen’s measurement techniques and an attempt to raise rates for the product. GroupM suggested that clients consider working with alternative players such as advertising technology company Innovid. Nielsen, networks and advertisers are all wrestling with the problem of media fragmentation, and nobody has charted a clear path forward yet. A number of competing companies, are selling supplementary data to some of Nielsen’s clients, but none has a product that’s competitive with Nielsen’s core TV ratings.

Identifying a replacement to step into the space has been challenging which means it’s still the big player in town. ComScore, VideoAmp and iSpot.tv were used during recent upfronts; none of them have an industry-wide traction to challenge Nielsen. This has resulted in Nielsen requesting a formal six month hiatus from the MRC accreditation process to allow them to focus on the development of Nielsen One, their cross platform media measurement currency, instead, in July, the MRC declined that request voted to suspend the MRC accreditation of Nielsen’s National Television service, to remove the current accreditation hiatus status designation from Nielsen’s Local People Meter and Set Meter Markets services, and to suspend accreditation for these markets under pressure from the VAB. The MRC confirmed they will no longer accredit Nielsen’s national or local measurement ratings. This move by the MRC essentially questions Nielsen’s validity as the measurement standard. The MRC cited these primary areas that need remediation in order for Nielsen to restore accreditation: Panel size and maintenance need to return to target levels, Business continuity and recovery processes need to be strengthened and tested, Processes for recording and communicating any changes in methods needs to be more transparent and clear and Nielsen’s decision to include broadband only homes in local measurement, following the methodology used in national measurement since 2013, was cited as the primary reason for suspending Local TV accreditation.

The entire industry is being affected by Nielsen’s inaccurate data measurement. It is speculated that the underreporting is in the millions of viewers translating to millions, if not billions of dollars in revenue. The industry’s unified structure built on Nielsen ratings is falling apart. While Nielsen can continue to function without accreditation this fosters distrust and erodes confidence in the established means of video advertising measurement industry. Nielsen is cognizant of the issues regarding their data collections, they’re reticent to admit the full scope of the issue. In the interim, the viewing habits of the consumer has change dramatically exposing the challenges and technical complexities inherent throughout the changing CTV landscape and neither Nielsen, nor any other company within the space has stepped up to address those issues.

In July, 38% of the time viewers watched cable TV; 28% of the time they watched streaming services; 24% of the time it was broadcast TV; and 10% of the time, they were doing something else on the TV screen, such as playing videogames or watching content saved on DVR.

Presently, Nielsen is under no burden to implement real change, because there is no pressure from competitors in the space. In order to regain accreditation, Nielsen needs to do the following: Return to targeted levels of panel size and maintenance, Strengthen and test their business continuity and recovery processes, Create a transparent and clear process for recording and communicating any changes in methodology. Nielsen in turn has charted a plan to retain their accreditation and put themselves back on a positive track: Work with the MRC to refine and audit universe estimates, ensure broadband/CTV only, cable and OTH homes are properly represented in their panels, Expand their sample by 15% by Q2 2023 and a Recovery target of 41,600 homes by Q1 2022. Nielsen plans to introduce the new measurement product in the fourth quarter of 2022 and secure its adoption by ad sellers and buyers by the start of the fall 2024 TV season. In 2021, the firm plans to start previewing the new data alongside the existing ratings product.

In the interim, networks are starting to build their own proprietary measurement products due to how watching TV shows has changed. If individual networks end up building their own measurement systems, then there will fracturing, resulting in a lack of uniformity across the landscape. Calls for more innovation and measurementare pushing for change in the way Nielsen operates and for more transparency within the measurement landscape. There is a call to action for speeding up changes and to fix antiquated methodologies for audience measurement, as well as a greater push to find new methods. NBCU already has taken action within, requesting RFPs from over eighty companies and plans to roll out a multi-company measurement effort over the following weeks and months. “As a global media buyer and seller, as well as a measurement customer, NBCUniversal understands the need for alternative measurement solutions,” said Kelly Abcarian, Executive VP for measurement and impact. NBCU has also announced the creation of a Measurement Innovation Forum recently revealing brands, holding companies and trading companies that have partnered with them and they include: Citicorp, Ford, L’Oreal, Rocket Mortgage, Target, Volkswagen,360i, Active International, Canvas, Dentsu, GroupM, Havas, Horizon Media, Magna, OMD, Publicis, RPA and Wieden+Kennedy, Ad Council, the Four As, the Association of National Advertisers, the Advertising Research Foundation, the IAB, Open A.P., TVB, VAB and the Media Rating Council. Additionally, ViacomCBS has entered into a partnership with VideoAmp to develop a new means of tracking the reach of advertising among linear and digital viewers. ViacomCBS intends to use VideoAmp data to guarantee linear media transactions against age and gender demographics, and to use it to back delivery of commercials to specific segments of audience. “We can create a lot more transparency and efficiency to reimagine the measurement ecosystem that will end in a multi-currency future that can flex depending on the needs of the advertiser.” John Halley COO, advertising revenue, ViacomCBS. FOX has also expanded its agreement with Comscore to include national TV measurement. “The rapid evolution of consumer behavior makes it more important than ever to have stable, granular audience measurement.” said Audrey Steele, executive VP of sales research insights & strategy for Fox. ComScore is seeking an MRC audit by October 15, 2021. Additionally, there have been calls for more innovation and measurement by CIMM (Coalition for Innovative Media Measurement)

Due to the complexity across video inventory informed by data, as well as the changing manner in which people consume, there are more platforms to access content:

Linear TV being the genesis of content consumption is content provided through set top boxes provided through Cable/Satellite live on traditional channels.

SVOD (Subscription) where the consumer pays a fee for access to content or AVOD (Advertising-based) where the content is free, but the consumer must periodically watch advertisements in order to continue watching the content Video on Demand give the consumer the ability to watch content they want when they want, as often as they want.

CTV (Connected TV) requires an investment by the consumer in Smart TV technology that connects to the internet or an OTT (Over the Top/Direct to Consumer) device with internet capability.

Mobile allows the consumer to view content on the internet via applications with either user authentication through cable subscriber or by free or paid subscription.

Web allows the consumer to view content on the internet with either user authentication through cable subscriber or by free or paid subscription.

DSP (Demand Side Platform) is an automated buying platform, where advertisers and agencies go to purchase digital ad inventory including banner ads on websites, mobile ads on apps and the web, and in-stream video.

Fragmented and outdated business models, as well as a disparity and lack of direction with regard to sales strategy have been leading businesses in the direction creating an industry wide problem with regard to audience measurement. There have been major shifts in viewership habits, exacerbated by the pandemic, and the VAB’s confirmation on the part of Nielsen significant inaccurate and underreporting of audience data acted as a catalyst to set into motion a call to action calls for new measurement systems and alternative currencies. While Nielsen works with the MRC to regain its accreditation, other companies like Comscore, TVSquared, Videoamp, Dumbstruck and others are stepping into the audience measurement space to make a case to assert themselves as the new definers of what audience measurement is and make the case that there shouldn’t be just one methodology for measurement. The future of audience measurement is still being define and redefined and Channel Media Solutions diverse pool of industry experts are here to partner with you every step of the way.

Fragmented and outdated business models, as well as a disparity and lack of direction with regard to sales strategy have been leading businesses in the direction creating an industry wide problem with regard to audience measurement. There have been major shifts in viewership habits, exacerbated by the pandemic, and the VAB’s confirmation on the part of Nielsen significant inaccurate and underreporting of audience data acted as a catalyst to set into motion a call to action calls for new measurement systems and alternative currencies. While Nielsen works with the MRC to regain its accreditation, other companies like Comscore, TVSquared, Videoamp, Dumbstruck and others are stepping into the audience measurement space to make a case to assert themselves as the new definers of what audience measurement is and make the case that there shouldn’t be just one methodology for measurement. The future of audience measurement is still being define and redefined and Channel Media Solutions diverse pool of industry experts are here to partner with you every step of the way.

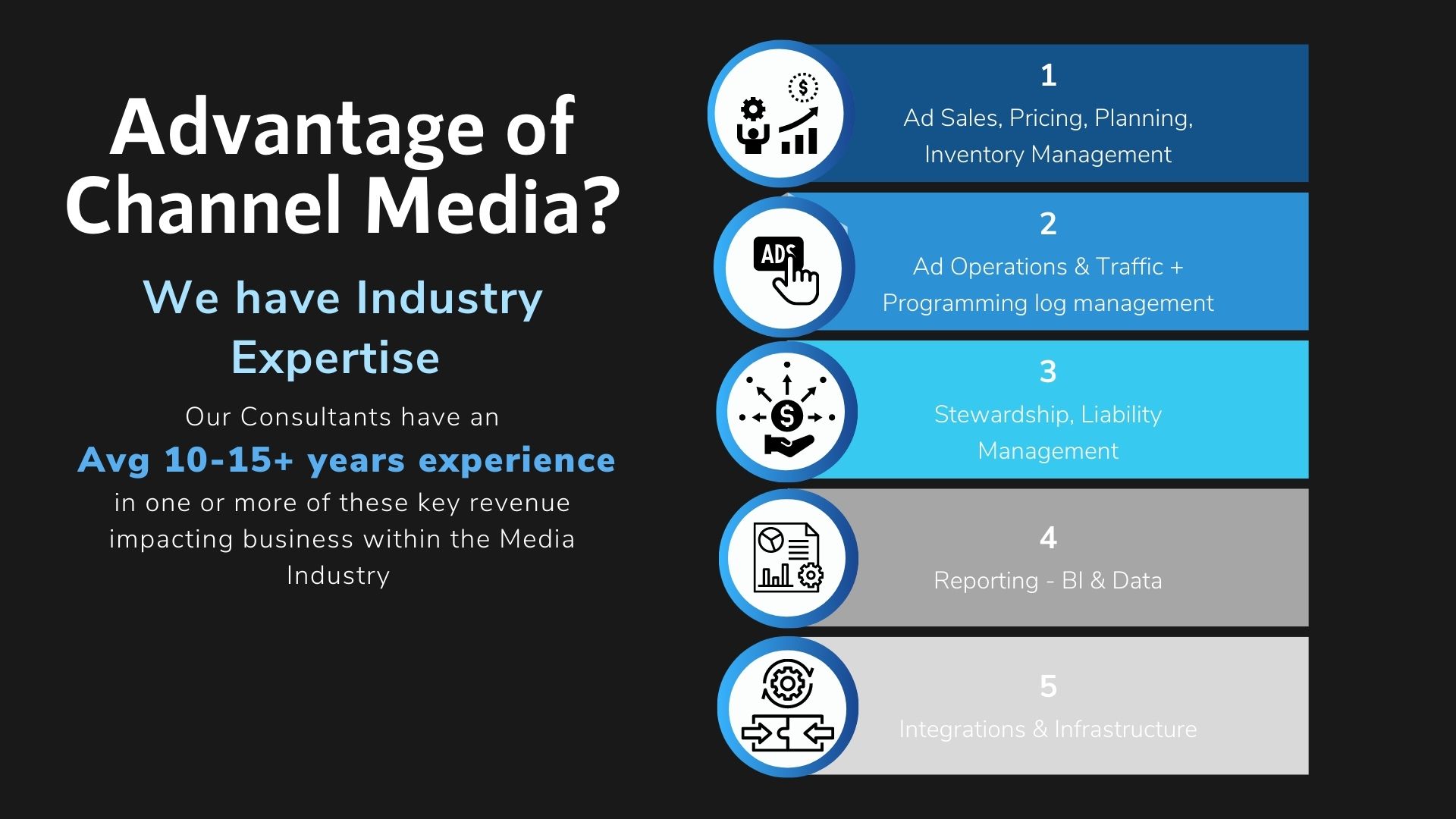

About Channel Media Solutions:

Channel Media Solutions is a boutique Media consulting firm that specializes in helping clients achieve maximum effectiveness with modernization, unification, and transformation of their technology solutions and strategies within the TV Network, Broadcast Media and Ad Tech industry.

Contact us at: Contact@channelmediasolutions.com

I recently sat down with Evan Shapiro for an industry coffee chat about the Ad Sales TV Industry...